tax loss harvesting rules

Capital gains tax is the tax on an investments profit once it has. To claim a loss on your current.

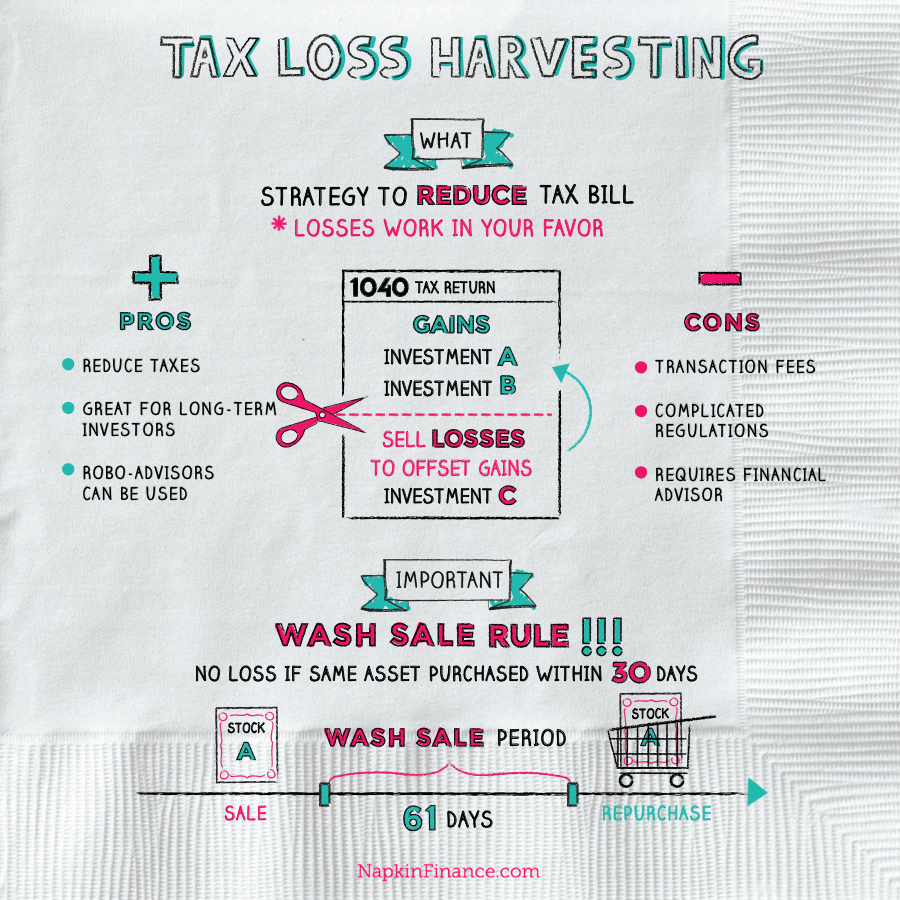

What Advisors Need To Know About Tax Loss Harvesting

A smart and efficient investor focuses keenly on all the tools on hand one of which is tax-loss.

. While implementing tax loss harvesting the capital. While implementing the strategy of tax loss harvesting the following rules should be kept in mind. Ad Vanguard Offers Clients a Tax-Efficient Hypercustomized Investment Experience.

Its not just all about capital gains boosting the bottom line. Build Custom Separately-Managed Accounts and Offer Real-Time Pitches to Prospects. Discover The Answers You Need Here.

As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Tax loss harvesting can be a great strategy to lower your tax bill. Ad Identify Tax Loss Harvesting Ideas To Help Your Clients Keep More Of What They Earn.

Ad Vanguard Offers Clients a Tax-Efficient Hypercustomized Investment Experience. It applies only to investments held in taxable accounts The idea behind tax-loss harvesting is to offset taxable investment gains. How tax-loss harvesting works 1.

Tax-loss harvesting sometimes referred to as tax harvesting is a strategy you can use for your taxable. Rules to Know for Tax Loss Harvesting Capital Losses in General. Ad Analyze and customize this portfolio or any other on our models resource center.

Tax-loss harvesting cant be used on retirement plans such as 401 k IRAs or other accounts where taxes are deferred. Tax-loss harvesting is the process of writing off the losses on your investments in order to claim a tax deduction against your ordinary income. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the.

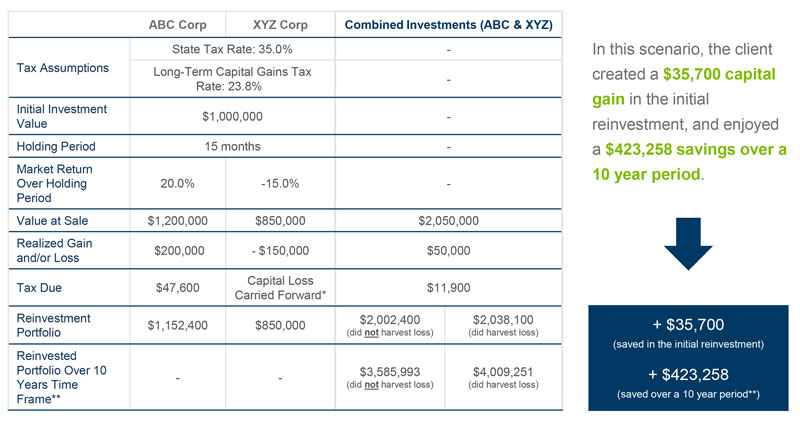

Generally a capital loss is a realized loss from the sale or exchange of a capital. Find Funds To Tax-Loss Harvest In Your Portfolio Using Tax Evaluator. A reduced income tax liability.

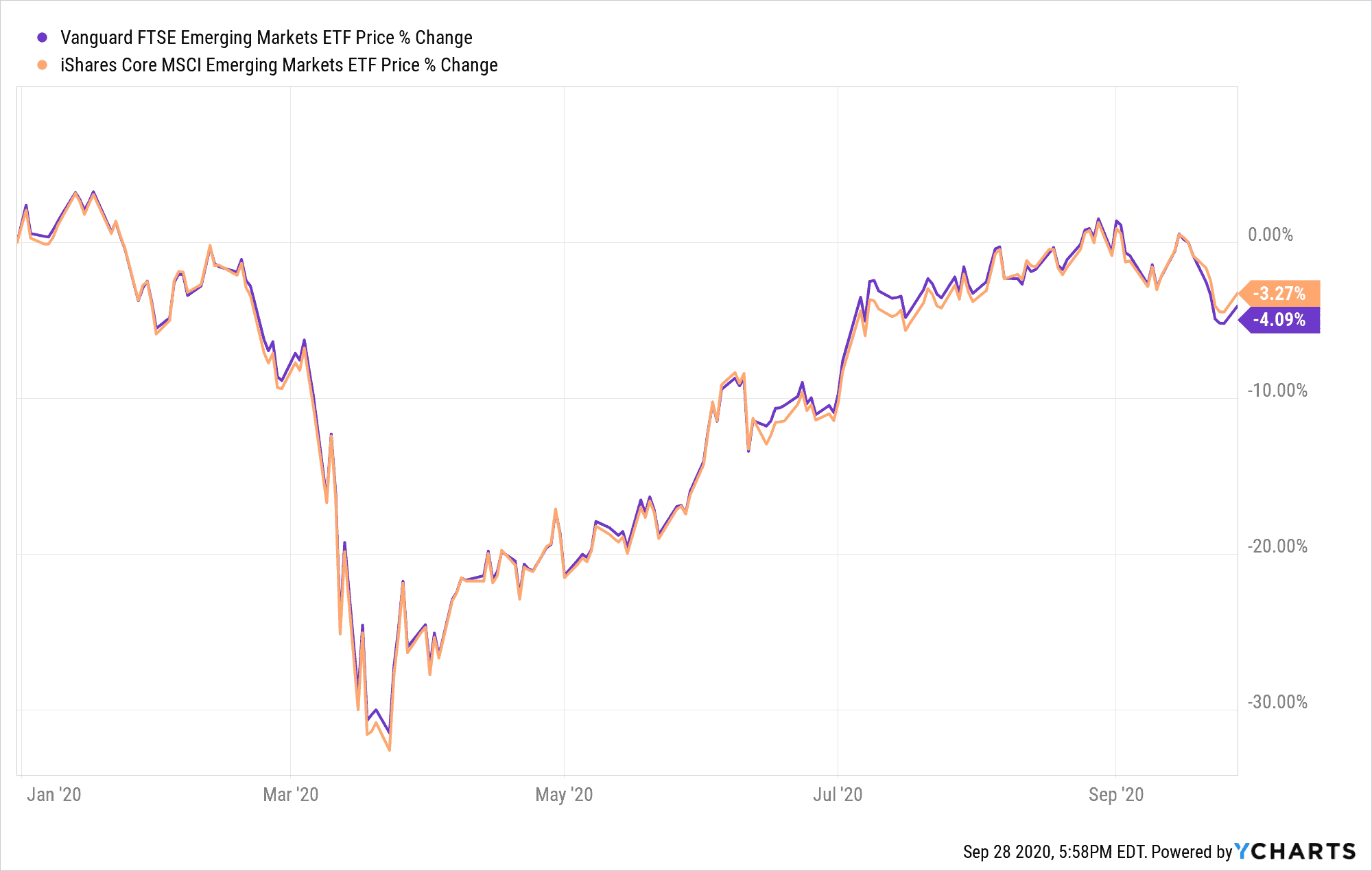

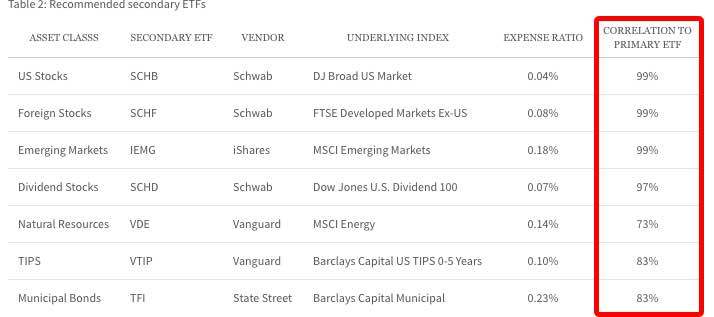

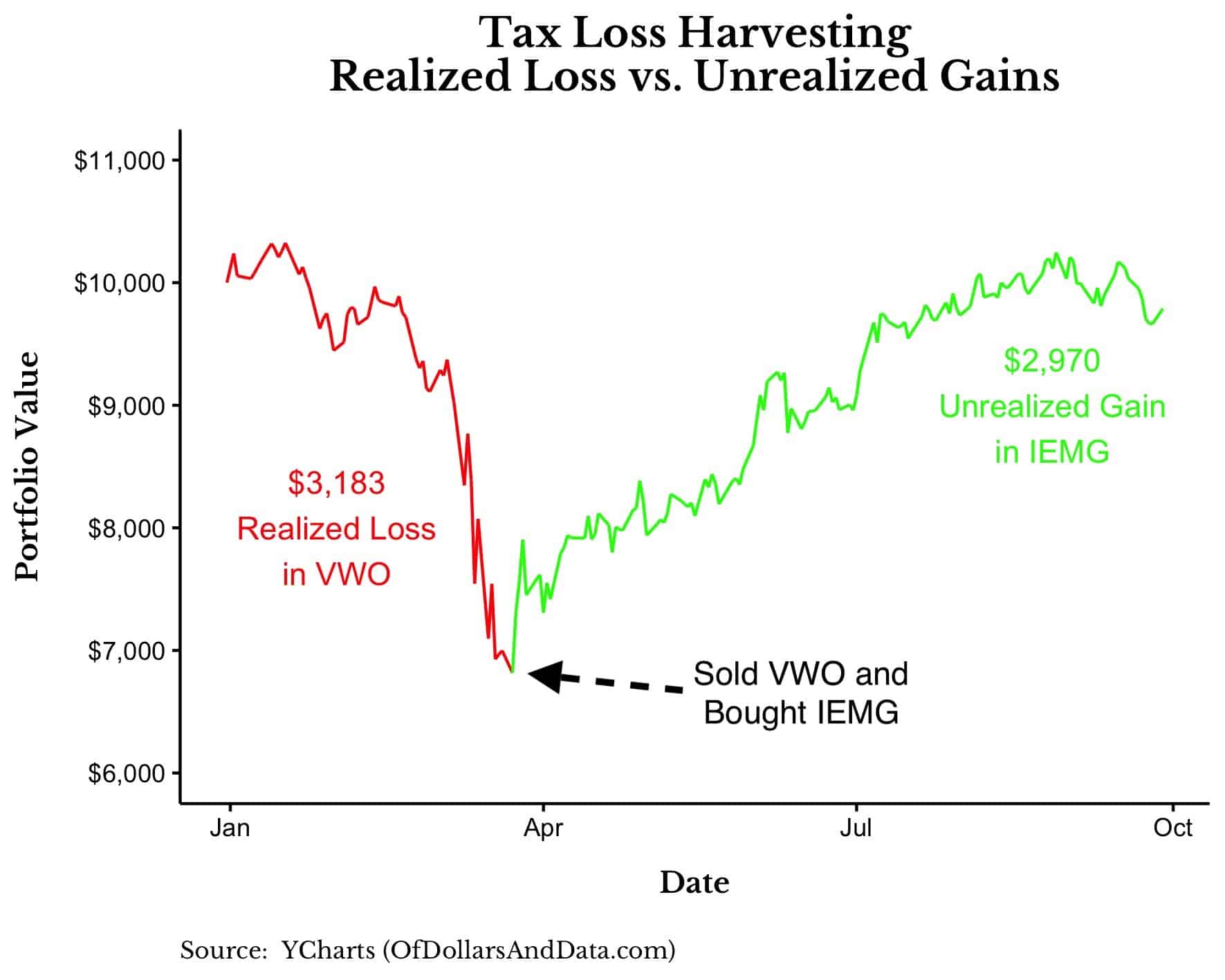

You have to wait 30 days to repurchase an investment you sold for a. Tax-loss harvesting is an investment strategy where an investor sells an investment that has gone down in value and buys into another investment. Build Custom Separately-Managed Accounts and Offer Real-Time Pitches to Prospects.

But it comes with one big restriction. Visit models resource center to compare analyze cutomize and follow portfolios. Start wNo Money Down 100 Back Guarantee.

Ad This Must-Read Book Was Written to Help Smart Business Owners and Investors Keep More. Rules of Tax Loss Harvesting. Tax loss harvesting rules are necessary to be aware of as it does not allow investors the liberty to buy or sell stocks anytime based on the realized losses and profits.

Lets discuss the rules and basics of tax-loss harvesting. Ad Honest Fast Help - A BBB Rated. What Is Tax-Loss Harvesting.

You are allowed to deduct up to 3000 per year of a short- or long-term capital loss from your ordinary income on your taxes. Reducing Tax liability - Tax loss harvesting reduces the tax burden on the investor by reducing the losses incurred from capital gains. As with any tax-related topic there are rules and limitations.

3000 per year for individual filers or married.

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting What Does It Mean To Be Substantially Identical Biglaw Investor

Tax Loss Harvesting What Is It Rules Example Benefits

What Is Tax Loss Harvesting Russell Investments

Tax Loss Harvesting A Guide To Save On Capital Gains

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Tax Loss Harvesting Turns Losses Into Gains Here S When To Skip It

Crypto Tax Loss Harvesting A Complete Guide Taxbit

.jpg)

How To Save Money With Cryptocurrency Tax Loss Harvesting 2022 Coinledger

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

Top 5 Tax Loss Harvesting Tips Physician On Fire

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Tax Loss Harvesting And Wash Sale Rules

Rate Moves Provide Big Fixed Income Tax Loss Harvesting Opportunities

Tax Loss Harvesting And Wash Sale Rules For 2021 And 2022 Increase Deductions And Tax Credits Youtube

Tax Loss Harvesting Upside To A Down Market Brown Advisory

Taxlossharvesting Napkin Finance

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire